Accounts Receivable – Finance And Treasury - Montclair for Dummies

How Accounts Receivable Affects the Cash Flow Statement for Beginners

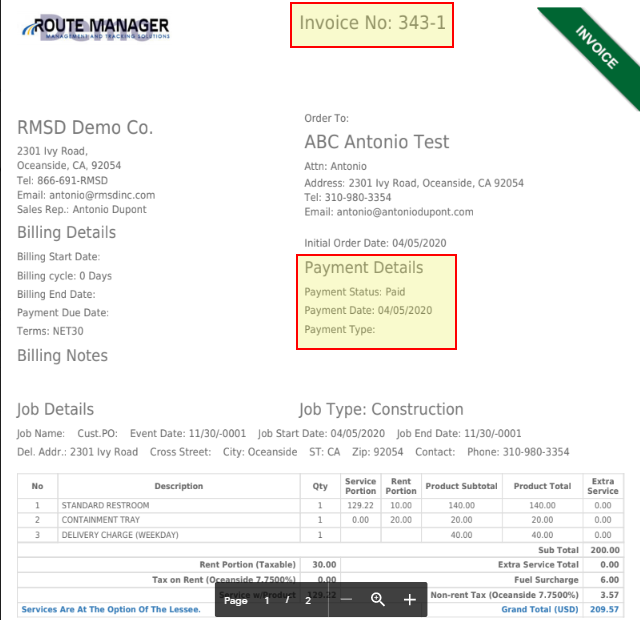

Claims for payment held by a company Accounts receivable, abbreviated as AR or A/R, are lawfully enforceable claims for payment held by a company for products provided or services rendered that customers have ordered however not spent for. These are typically in the type of invoices raised by a company and delivered to the consumer for payment within a predetermined amount of time.

Accounts Receivable Collections Best Practices

Accounts Payable And Accounts Receivable - Aplos Training Center

It is among a series of accounting transactions dealing with the billing of a consumer for items and services that the consumer has ordered. These might be differentiated from notes receivable, which are debts produced through formal legal instruments called promissory notes. Key Reference [edit] Accounts receivable represents money owed by entities to the company on the sale of product and services on credit.

The sales a business has actually made. The quantity of money received for goods or services. The amount of cash owed at the end of each month varies (debtors). The balance dues team is in charge of getting funds on behalf of a company and applying it towards their current pending balances.

Some Ideas on Accounts Receivable - Financial Reporting & Operations, UVA You Should Know

While the collections department seeks the debtor, the cashiering group uses the cashes got. Accounts receivable can make effect on liquidity of the company, hence it is essential to focus on this metrics. For that reason the investment danger must be as little as possible. Payment terms [edit] An example of a typical payment term is Net thirty days, which implies that payment is due at the end of thirty days from the date of billing.

Other common payment terms include Net 45, Net 60 and thirty days end of month. The lender might have the ability to charge late charges or interest if the amount is not paid by the due date. In practice, the terms are frequently revealed as 2 fractions, with the discount and the discount rate duration comprising the very first fraction and the letter 'n' and the payment due duration consisting of the second portion.

Booking a receivable is achieved by a basic accounting deal; however, the procedure of preserving and gathering payments on the balance dues subsidiary account balances can be a full-time proposal. Depending on the industry in practice, balance due payments can be received as much as 10 15 days after the due date has actually been reached.